Ever wished you could get a helping hand with your mortgage? Where you could make your mortgage repayment with greater ease or even see your mortgage coming down that little bit faster, leaving you feeling more confident and in control of your financial future? Yes! Me too…

Which is why I am so excited about sharing something that I just found out about myself, and it works, costs nothing and helps save you precious time, valuable money and acts as a beacon where you can finally see light at the end of the tunnel, where having a mortgage free life is worth imagining.

Grow My Money is Australia’s first, one of a kind, innovative cashback program, that allows you the opportunity to earn cashback on your existing, everyday shopping, both online and instore, with the cashback being deposited directly onto your home loan as an extra mortgage repayment.

And not only can you earn up to 15% cashback, you can stack your savings, still accessing the same prices, sales, coupon codes*, promotions and special offers that you normally would.

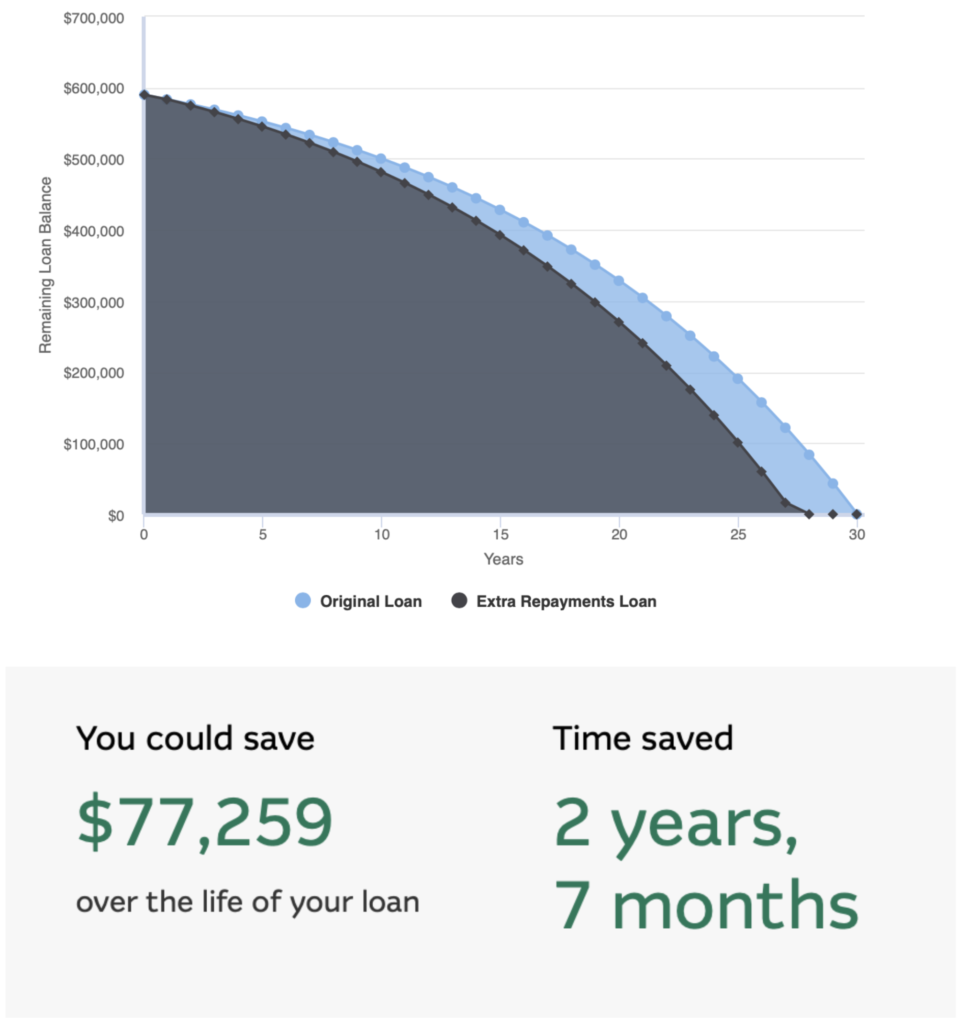

And we all know that even the smallest extra repayment on your home loan can have a profound impact in saving you time and money, especially if you can maintain your current repayments as is and interest rates remain stable (let us pray). But let me show you exactly how profound this is, because this is magical.

If we take a mortgage of $600,000, with an interest rate of 6.5% p.a. assume no fees and no further interest rate rises, on a 30 year term, 1 year into the loan term, and you can make an extra lump sum repayment of $100 per month, you could save up to $77,000 and potentially be mortgage free up to 20 months sooner!

So how realistic is earning $100 per month from Grow My Money? Well according to The Australian Financial Review, in 2022 we spent as a country alone, over $62.3 billion online. So there are plenty of opportunities to earn some extra cash, just by going about our normal everyday shopping activities, such as your weekly grocery shop, insurance products and utilities.

And speaking from personal experience, without really trying, I received over $880 this year from utilizing cashback programs, without really trying. In fact, I am already owed another $115 as I type. And with over 1,500 different retailers (online and in-store), that you could earn cashback at, covering food, clothing, technology, homewares and more, you shouldn’t miss any opportunity to earn cashback on your normal living expenses and get your mortgage heading in the right direction, i.e. down.

So how do you use Grow My Money to help maximise your cashback opportunities?

Easy. This is what I recommend…

- Download the Grow My Money Application so that you know what special offers are available at the usual stores that you already shop with or at.

- Download the extension browser on your desktop so that you are always alerted of any opportunities to earn cashback.

- Link your card for efficiency with check out.

- Nominate your compatible mortgage loan account.

- Continue on shopping as you normally would, enjoying those extra lump sum repayments each time, sustainably reducing your mortgage.

As a Financial Planner with over 2 decades of experience, I cannot tell you the financial and emotional relief that is experienced when you see debts under control and reducing. And this is exactly what Grow My Money is all about. Helping everyday Australians cope better with the stresses and pressures of rising interest rates and the cost of living, whilst being in a powerful and positive alignment to an important financial goal, of a mortgage free life.

So if you are ready to turn your spending into serious time and money savings, start your journey to a mortgage free life with Grow My Money today! Your future responsible and wise self will thank you for it.

* A shopper cannot earn cash back with coupon codes that are not provided by GMM.

Proudly sponsored by Grow My Money.